Turn your "Savings" Account to a real estate "Profit" Account. Earn interest on your principal like a bank

You're about to discover the secret of using your money to make more money.

We've created this Private Lending Program for you to give you the answers to these important questions and challenges everyone wants to know before getting started.

How can I trust an investor to find good deals in this terrible market and economy?

How much money will I really make?

Are my investments secure? Can I lose the whole investment?

Investment bankers,

financial planners, banks

and fund managers

do not want

you to have

this info because

all of their options

come with fees.

Learn more about

the best option

for you.

THE LOREM

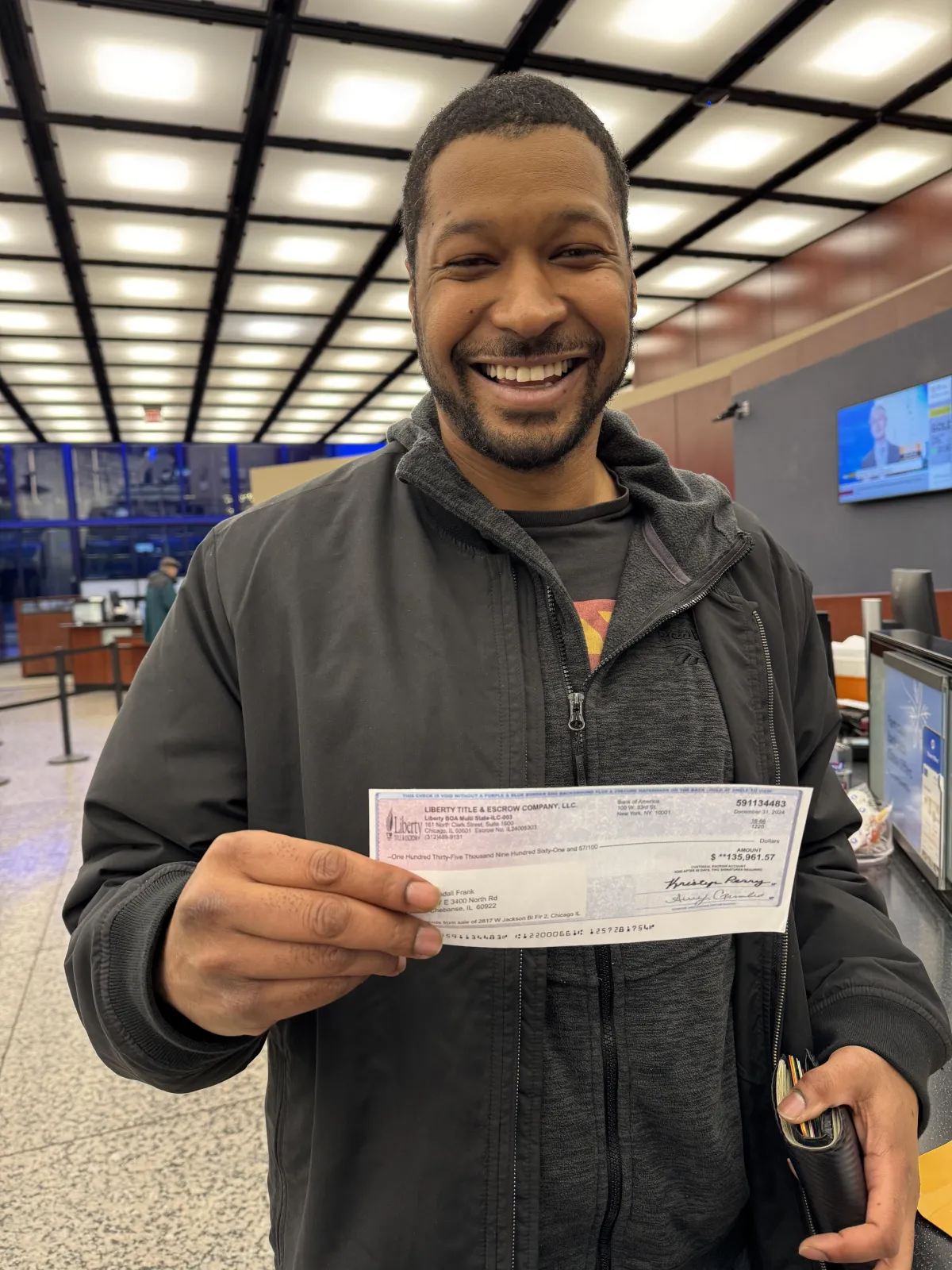

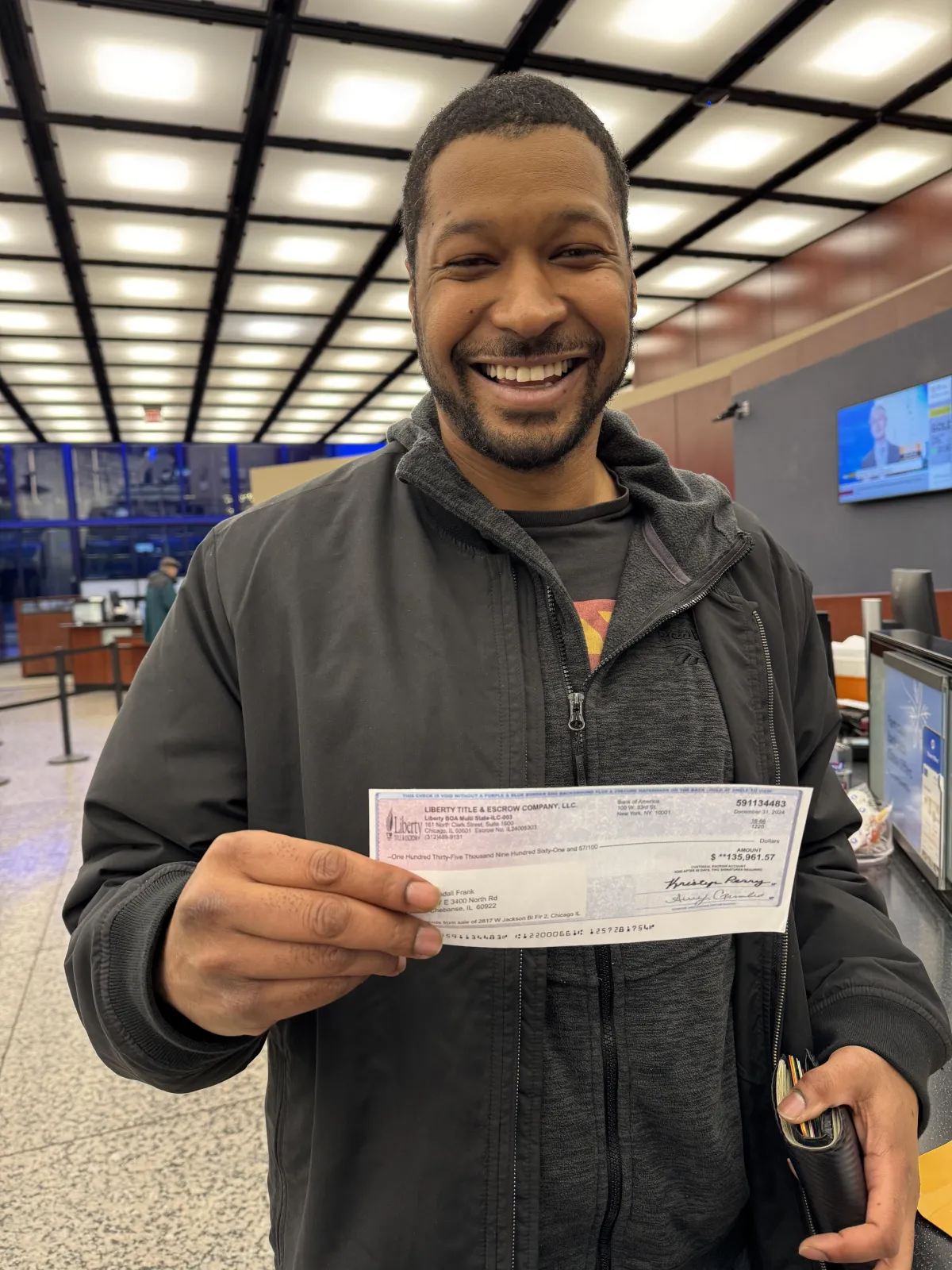

About Ken Frank

Ken Frank is a real estate investor and real estate investing coach. He began his real estate investing journey on the Westside of Chicago, in a neighborhood called East Garfield Park, where he purchased his 1st multi-family home with no money down and inherited tenants.

This journey from rental income to evictions and back to big checks in real estate. Real estate is a hard journey but you can learn from Ken's real life experiences.

Ken Frank authored his 1st book "The 1 Page Plan To Buy Your 1st Real Estate Investment"

This book goes over basic step by step concepts to get you started in real estate. Are you scared about getting started, take advantage of this FREE book offer.

© Copyright 2025. 911 Home Investor. All rights reserved.